50/30/20 Rule: A Beginner’s Guide to Saving Money

If managing money feels challenging, you’re not alone. Between bills, savings goals, and trying to enjoy life, finding balance can be tough. That’s where the 50/30/20 rule helps — a simple, beginner-friendly budgeting method that keeps your finances organized without complex tools or spreadsheets.

What Is the 50/30/20 Rule?

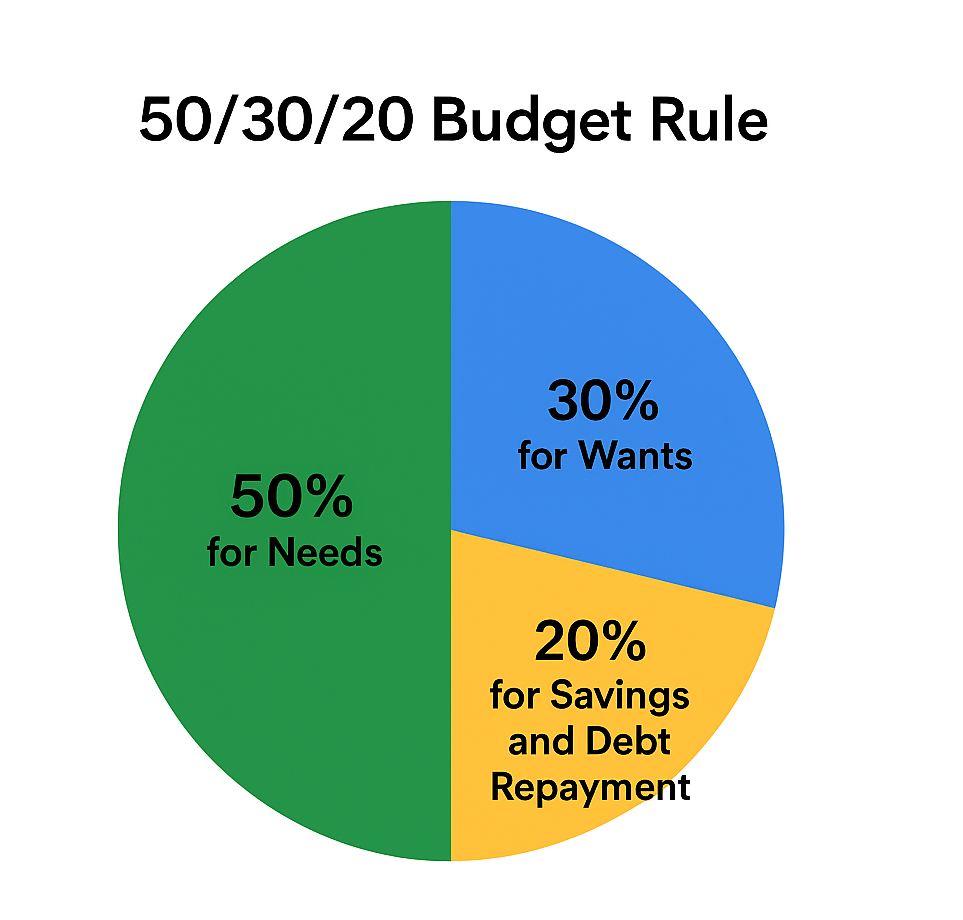

The 50/30/20 rule divides your after-tax income into three easy categories:

- 50% for Needs

- 30% for Wants

- 20% for Savings and Debt Repayment

This method was popularized by U.S. Senator Elizabeth Warren in her book All Your Worth: The Ultimate Lifetime Money Plan. It’s a realistic approach to help you live comfortably today while still preparing for tomorrow.

Spend 50% on “Needs”

Needs are essentials you can’t live without — the foundation of your budget. Examples include:

- Rent or mortgage

- Utilities (electricity, water, internet)

- Groceries and insurance

- Transportation and car payments

- Minimum loan or credit card payments

Tip: If your “needs” go beyond 50%, look for small adjustments — refinance a loan, switch to a cheaper plan, or reduce utility usage.

Spend 30% on “Wants”

These are your lifestyle choices — the things that make life fun but aren’t essential. Examples include:

- Eating out or ordering coffee

- Netflix, Spotify, or other subscriptions

- Shopping, hobbies, or travel

You don’t need to give up everything you love — just be intentional about your spending. Prioritize what brings real joy and skip the rest.

Allocate 20% to “Savings and Debt Repayment”

This portion builds your financial freedom. It includes:

- Emergency fund contributions

- 401(k) or IRA retirement savings

- Extra payments on credit cards or loans

- Investments (mutual funds, ETFs, etc.)

Even small steps count. The key is to be consistent — saving $100 every month is better than saving nothing at all.

Example Budget Breakdown

If your take-home pay is $4,000 per month:

| Category | Percentage | Amount |

|---|---|---|

| Needs | 50% | $2,000 |

| Wants | 30% | $1,200 |

| Savings/Debt | 20% | $800 |

Why the 50/30/20 Rule Works

- Simple – No complicated calculations or software

- Flexible – Fits most income levels and lifestyles

- Balanced – Encourages saving and living

- Mindful – Keeps you aware of where your money goes

How to Start Using the Rule

- Know your after-tax income. (Use your paycheck or a take-home pay calculator.)

- Track your expenses. Write down what’s a need, want, or saving.

- Adjust slowly. Make small changes each month.

- Automate savings. Set up automatic transfers right after payday.

Final Thoughts

The 50/30/20 rule gives you a clear path to manage your money — without giving up your lifestyle. Whether you’re saving for an emergency, paying off debt, or planning your next trip, this framework helps you spend wisely and save steadily.

Remember: budgeting isn’t about saying “no” — it’s about knowing when to say “yes.”

Take Control of Your Money Today

If this guide helped you, share it with a friend who struggles with budgeting — or start your 50/30/20 plan now and take the first step toward financial peace of mind.